New Rochelle Man Back in Federal Court on 2007 Fraud Charges

Philip Colasuonno Still Owes Government $2.5 MM, Feds Say

WHITE PLAINS, NY (May 11, 2022) -- Magistrate Judge Judith C. McCarthy held a preliminary conference Tuesday at the United States Courthouse in White Plains, NY in a civil lawsuit filed by the United States of America against Philip Colasuonno for his alleged Failure to Collect and Pay Over Tax, or Attempt to Evade or Defeat Tax.

Words in Edgewise is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Judge McCarthy heard from Anthony Jan-Huan Sun representing the United States of America and Erin Kathleen Flynn representing Philip Colasuonno on their understanding of what the case is all about.

Jan-Huan Sun said the case began in 2007 when an armored car company failed to pay benefit taxes for its employees. Philip Colasuonno was found to be an individually responsible person in the case.

Colasuonno served 4 months in Federal prison for probation violations then pleaded guilty, was sentenced to time served, was given supervised release and ordered to make restitution of $781,467.

Judge McCarthy asked Flynn how much Colasuonno had paid. She said it was almost $100,000 through garnishment of his social security payments. With interest, the outstanding balance is now about $2.5 million.

Flynn told Judge McCarthy there were three issues in the case: double penalization of her client, discovery related to a notice sent in error and statute of limitations.

Jan-Huan Sun and Flynn offered legal arguments on the statute of limitations issue until Judge McCarthy cut them off saying the debate was not the best use of time, concluding that discovery should be stayed until the statute of limitations issue was determined.

A motion schedule was established by Judge McCarthy. Flynn must file her 12B6 motion by July 1, Jan-Huan Sun must file his Opposition by July 22, Flynn must file her reply.

Thank you for reading Words in Edgewise. This post is public so feel free to share it.

Questions readers have raised were not answered in court today.

The top question is: Why the United States of America would wait until the last minute — or past it if Flynn wins on her motion — to file their lawsuit? Did it have anything to do with our reporting on Colasuonno’s case last summer? Did they just forget?

It is a well documented fact that Philip Colasuonno is a liar, fraud, cheat, and former Federal prisoner whose word is not worth the paper it is written on, so there is every reason to cast doubt on everything he says or does, in particular whether he has ownership or control or the benefit of anything that could be seized by the government and applied to the roughly $2.5 mm he owes to the government.

With Philip Colasuonno, it is best to assume the worst, so every question is fair game.

What about the house where he resides at 124 Davenport in the Sans Souci neighborhood of New Rochelle?

Zillow estimates the property to be worth about three-quarters of a million dollars.

Philip Colasuonno was the owner until May 12, 2003, when he sold it for $10 to his wife, Marie Josephine Colasuonno, according to New Rochelle property records.

There are many vehicles in the driveway. Who has the use of those vehicles? Who are the listed owners? Which ones does Philip Colasuonno drive?

The property is a 2-Family residence, so there may be a rental income, on or off the books. How much is that?

That looks like a nice beach house. Where is it? Who owns it? Why does Philip Colasuonno have the use of it?

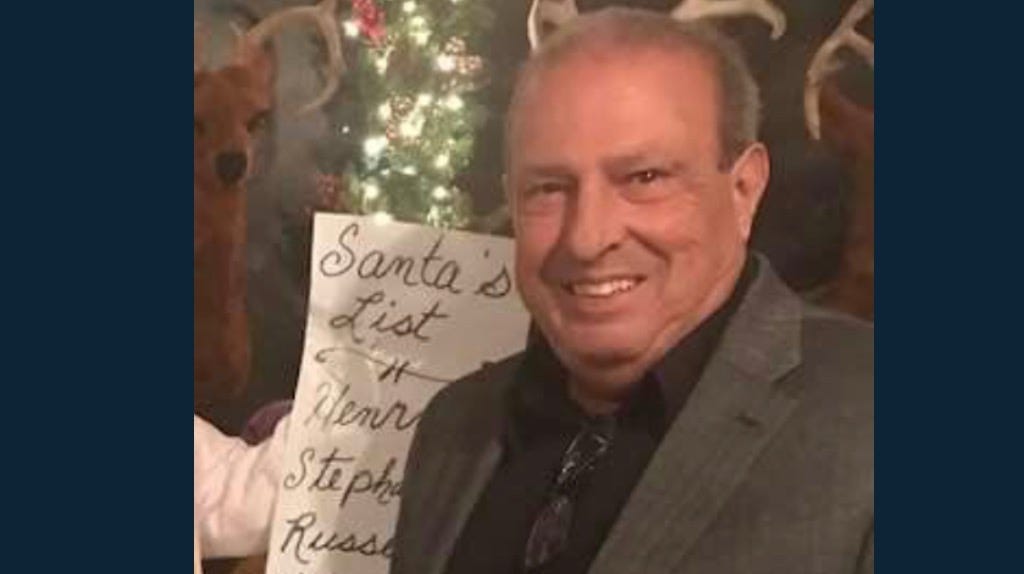

Why is Philip Colasuonno among those at a dinner at the now-defunct Christopher by Chef Joe restaurant to thank the people “helping to make our dream come to fruition”. How did Philip Colasuonno help make the dreams of Chris and Tracy Greco “come to fruition”? Why is he being thanked and what for? How did he help? Did he put up money? Did he make in-kind contributions? Did he have an equity stake?

Philip Colasuonno has his name on a tax and accounting service that operates out of a house on Drake Avenue. What is his connection to that property? Is he paid a salary, or does he otherwise derive income or other benefits from Philip Colasuonno & Associates LLC? Who are his clients?

Philip Colasuonno is the Treasurer of the Sans Souci Homeowners Association and the Sans Souci Pool and Tennis Association. Why would any organization, let alone two, put a convicted felon who committed bank and tax fraud, a person who has still never paid his multi-million dollar debt to society, in charge of their money? Are these organizations adhering to their dual-signer policy for checks? What was Colasuonno’s role in the possibility illegal $50,000 HSBC bank loan borrowed, inexplicably, against the co-mingled assets of both organizations for the benefit of one, the Sans Souci Pool and Tennis Association? Is Colasuonno using the HOA or Pool and Tennis Association funds for his benefit? Have the books been independently audited? Have the books been opened to HOA or Pool and Tennis Association members?

The biggest question is: Why Philip Colasuonno is an officer of the Sans Souci HOA when the by-laws require that an officer be a member and a member must be a property owner?

If owning property is a requirement to be a board officer and Philip Colasuonno is a board officer, then it follows he owns property in Sans Souci.

THE CONSTITUTION of ISLE OF SANS SOUCI HOME OWNERS ASSOCIATION, INC.

Article III Membership Sec. 1: “An owner of a lot or a home built on any lot or lots lying in Parcels A and B, as heretnafter described, shall have the right to become a member of this Association; provided, however, that he shall adhere to the Constitution, by-laws, and rules and regulations of the Association.”

Article III Membership Sec. 2: “The Association shall have the right to consider as eligible for membership, those persons who have unrecorded deeds, leases and including those who have entered into written contracts of sale and purchase of property, and arranged for the erection of a home or homes thereon. A majority vote of the members present at a general meeting of the Association shall be required to grant such membership under the category set forth in this section.”

Article III Membership Sec. 3: “Every member in good standing, regardless of the number of lots owned by him, shall have one vote in this Association.”

Article III Membership Sec. 8: “Where premises are owned in severalty or jointly, such owners shall be eligible for membership under rules adopted by the Executive Committee. However, each home or lot shall have only 1 vote in the Association.

The question rests on Article III Membership Sec. 8. If Philip Colasuonno is claiming he is eligible to be Treasurer because 124 Davenport is owned by Marie Josephine Colasuonno and Philip Colasuonno is married to Marie Josephine Colasuonno, so 124 Davenport qualifies as premises owned in severalty or jointly is it then his property. If so, why has the government not seized the property? Is it protected as a residence, and if so, why?

The requirements for membership in the Sans Souci Pool and Tennis Association are even more stringent: a member must have record title to a property within the metes and bounds of Sans Souci. 124 Davenport is owned by Marie Josephine Colasuonno. She has record title not Philip Colasuonno, so he is not the member and so not eligible to be an officer. Yet, he is an officer.

RELATED:

Nightmare on the Isle of Sans Souci: Part IV — Who is Phil Colasuonno?

Nightmare on the Isle of Sans Souci: Part V — What is Christopher’s Voice?